CYPRUS TAX OVERVIEW

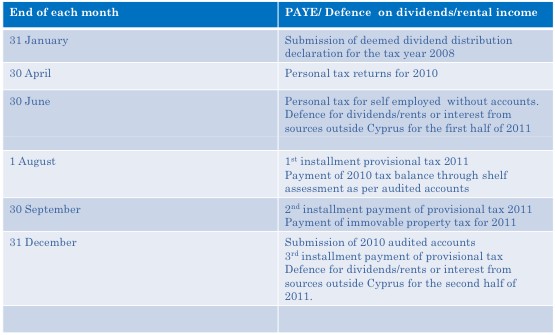

TAX CALENDAR

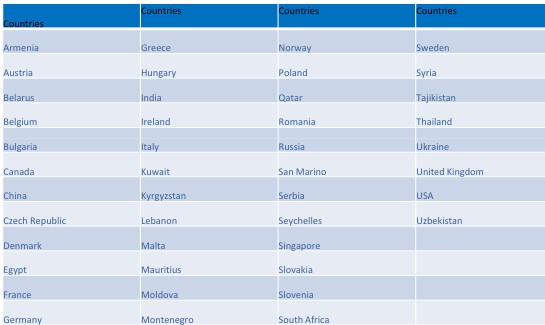

DOUBLE TAX TREATIES

- Payments of dividends and interest to non residents are exempt from withholding tax in Cyprus according to the Cyprus Legislation.

- Cyprus – Sweden Convention signed 25 October 1988 between the Republic of Cyprus and the Kingdom of Sweden for the avoidance of double taxation with respect to taxes on Income

- Persons scope o Taxes Covered

- Resident

- Permanent establishment

- Income from Immovable property o Interest

- Royalties

- Capital Gain

- Elimination of Double Taxable

- Exchange of information

CAPITAL GAINS TAX

- Capital Gains Tax is imposed on gains from disposal of immovable property situated in the Republic including shares of companies not listed on recognized Stock Exchange which own immovable property situated in the Republic, at the rate of 20%.

- In computing the capital gain the value of the immovable property as at 1 January 1980 (or cost if the date of the acquisition is later), the cost of any additions after 1 January 1980 or the date of acquisition if later, any expenditure incurred for the production of the gain and the indexation allowance, are deducted from the sale proceeds.

- Major Exemptions

- Transfer on death

- Gifts between spouses, parents and children and relatives up to third degree

- Gift to a company whose shareholders are members of the donor’s family and continue to be members of the family for a period of five years from the date of the gift

- Gift by a family company to its shareholders , if the company had also acquired the property in question via donation. However if the shareholder disposes the property within 3 years then the shareholder will not be entitled to the individual deductions.

- Transfer of ownership or share transfers in the event of company re-organizations

Formation of Cyprus IBC

Cyprus maintains and enhances its competitiveness as a reputable international financial center and distinguishes itself from the infamous tax heavens.

Advantages of Cyprus IBC

Read further advantages for the formation of International Business Companies in the island of Cyprus.