CYPRUS TAX OVERVIEW INCOME TAX-PERSONAL

An individual is a resident in the Republic, tax is imposed on income acquiring or arising from sources both within and outside the Republic.

Where an individual is not a resident in the Republic, tax is imposed on income accruing or arising only from sources within the Republic.

Resident in the Republic is an individual who is present in the Republic for a period exceeding 183 days in a tax year.

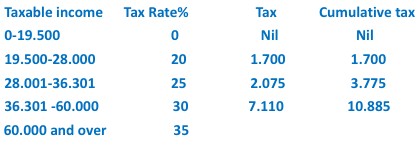

Tax rates

PERSONAL ALLOWANCES

- Life insurance

- Medical insurance

- Social insurance

- Provident fund contributions

- The whole of the above amount up to 1/6 of the taxable income before this allowance

- Subscription to professional bodies

Formation of Cyprus IBC

Cyprus maintains and enhances its competitiveness as a reputable international financial center and distinguishes itself from the infamous tax heavens.

Advantages of Cyprus IBC

Read further advantages for the formation of International Business Companies in the island of Cyprus.